Finance with Sharan: Cracking the Code of Influencer Success

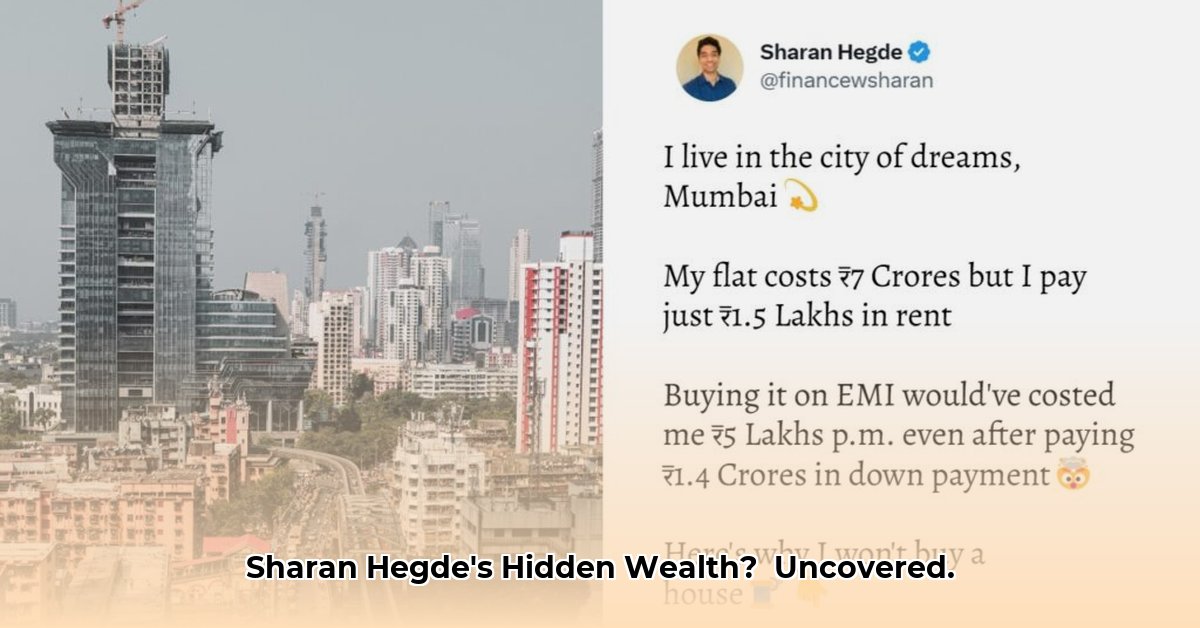

Sharan Hegde's remarkable ascent in the finance influencer sphere is a compelling case study in strategic marketing and audience engagement. While the precise figure of his net worth remains undisclosed, his substantial online presence across platforms like Instagram and YouTube, coupled with his recognition in publications such as Forbes, undeniably points to significant financial success. This case study examines the key elements of his strategy, offering actionable insights for aspiring influencers and brands seeking to build a successful and ethical presence in the financial space. How did Hegde achieve this level of success and what lessons can we learn from his journey?

Unmasking the Success: Sharan Hegde's Impact

The exact net worth of Sharan Hegde remains unverified, yet his influence is undeniable. His millions of followers across various platforms highlight a highly effective strategy. This success underscores the power of impactful content and community building. However, this also underscores a crucial risk: online personas don't always reflect the complete picture, emphasizing the importance of critical evaluation and due diligence when assessing financial influencers. How much is truly attributable to his influence versus inherent market factors? The answer lies in a deep dive into his strategies.

The Hegde Method: Making Finance Approachable

Hegde's mastery lies in his ability to simplify complex financial concepts, making them relatable and engaging for a broad audience. His use of humor and relatable anecdotes transforms potentially intimidating topics into easily digestible content. He successfully bridges the gap between financial literacy and personal connection, fostering a sense of trust and community with his followers, which translates to high audience engagement and loyalty. How has Hegde built this level of rapport with his large following? The answer is intentional content strategy and community building.

Building a Sustainable Brand: Strategy and Long-Term Viability

Hegde's success is not merely the result of luck; it's a testament to a well-defined strategy. His consistent brand identity, strategically employed across multiple platforms, fosters strong audience recognition and loyalty. However, the sustainability of this model depends on adaptability and innovation. The ever-changing algorithms of social media platforms and evolving audience preferences necessitate a dynamic approach. The question remains: Can this model endure long-term? The answer lies in his commitment to evolving and adjusting his approach.

Key Learnings from Sharan Hegde's Success: An Actionable Guide

What can aspiring finance influencers learn from Hegde's journey? Here are three pivotal takeaways:

- Niche Expertise: Specializing in a specific niche within personal finance (e.g., budgeting for young adults, investing in cryptocurrencies (digital currency systems)) allows for focused content creation and targeted audience engagement.

- High Quality Content: Creating high-quality, engaging content that's truly helpful and adds value is paramount. This involves consistent effort, meticulous research, and a deep understanding of the audience's needs.

- Community Building: Fostering authentic relationships with followers goes beyond simply posting content; it's about creating a space where people feel heard and valued. This fosters loyalty and strengthens the influencer's brand.

Risk Mitigation in Finance Influencer Marketing: A Comprehensive Analysis

The finance influencer landscape presents unique challenges and risks. Effective risk management is crucial for longevity and ethical operation. Hegde's success highlights the importance of mitigating these risks:

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Algorithm Changes | High | Significant | Diversify platforms, build an email list, engage directly with the audience. |

| Misinformation/Regulation | Medium | Severe | Rigorous fact-checking, adherence to regulations, legal counsel. |

| Brand Reputation Damage | Medium | Catastrophic | Transparency, partnerships with reputable brands, careful vetting of collaborations. |

| Audience Engagement Decline | Medium | Moderate | Adaptable content, audience feedback, active participation in conversations. |

| Competition | High | Moderate | Unique voice and content differentiation, strong community building, loyalty programs. |

Successfully navigating these risks requires a proactive approach and a commitment to ethical practices.

How to Evaluate Finance Influencer Claims: A Critical Approach

The allure of quick wealth often overshadows critical thinking when assessing finance influencers. How can we differentiate genuine success from carefully constructed online personas? This section provides a framework for evaluating claims:

Deconstructing the Narrative: Examining the Influencer's Story

Many influencers present a simplified narrative, omitting challenges and potentially misleading practices.

- Scrutinize their story: Look for verifiable evidence of their claims. Cross-reference their assertions with publicly available information. Consistently growing revenue, rather than sudden wealth, suggests credibility.

- Seek third-party validation: Awards, established partnerships, or features in credible publications lend credence but aren't foolproof; always perform further research.

Verifying Income Sources: Beyond the Surface

Analyzing the influencer's claimed income sources is critical:

- Investigate income diversification: Multiple, transparent income streams are more credible than single, unexplained sources.

- Analyze social media: Do their claims align with their online persona? A consistent picture over time demonstrates greater trustworthiness.

The Importance of Independent Verification: Due Diligence

Relying solely on self-reported information is insufficient:

- Cross-reference information: Use multiple sources to verify the influencer's claims—business registries, company websites, and news articles.

- Seek professional advice: Consult a financial advisor before making any investment decisions based on an influencer's recommendations.